Unexpected parallels between philanthropy and taxation

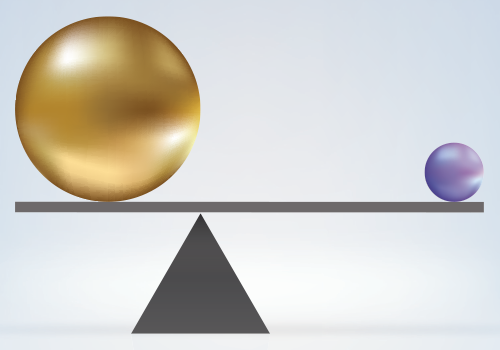

At first sight, taxation and philanthropy have little in common. Whereas taxation is a coercive mechanism, through which states levy revenue and then reallocate it according their policy objectives, philanthropy is a voluntary and altruistic way of redistributing private wealth. You have no choice but to pay taxes, whereas you have every right not to give anything to charity.

Those seemingly irreconcilable differences between the domains diminish once you start looking deeper. In fact, the majority of states in the world encourage philanthropic actions with certain forms of subsidies, which are often in the form of taxes. For instance, donors might be able to deduct their charitable gifts from their taxable or income taxes, or receive similar tax relief in other forms of state subsidies. This inevitably raises multiple questions, which go far beyond the realm of law that puts such tax rules in place. Why should the state sponsor private philanthropy? Is such delegation of budgetary powers compatible with the principals of a democratic state? Are such tax measures efficient, do they increase philanthropic giving? Could we really say that a gift is altruistic if it is motivated by (sometimes very scrupulous) tax planning? In this case is it not the state that is being philanthropic, the philanthropists being egoistic?

The Routledge Handbook of Taxation and Philanthropy, edited by Henry Peter and Giedre Lideikyte Huber of the Geneva Centre for Philanthropy, provides the first comprehensive multidisciplinary analysis of the interaction between these domains, seeking answers to those complex academic and practical questions and encouraging further discussions. Analysing this heterogeneous topic, it resembles academics’ contributions from multiple scientific disciplines, such as philosophy, law, sociology, economics and political science.

The structure of the handbook revolves around four topics. The first part, called “Justification of tax incentives for philanthropy”, consolidates contributions exploring diverse aspects of the justification of tax incentives for philanthropic initiatives. The analysis ranges from a historical overview of the notion of philanthropy (Atkinson) to contemporary problems, such as distinguishing between charitable and political activities (Carmichael), passing through other domains, for instance philosophical considerations about the concept of the “gifting puzzle” (Tieffenbach).

The second main topic, “Taxes, efficiency, and donor behavior: theoretical and empirical insights”, ventures into the economic and technical aspects of tax incentives for philanthropy, analysing the very concept of efficiency as well as exploring and comparing various tax incentive models.

The third part, entitled “Tax incentives for cross-border philanthropy” dives deeply into a very under-researched area of transnational philanthropic giving and taxation. The authors challenge the historical arguments, which are still used to justify limiting philanthropic activities within national borders, such as the risk of misallocation of funds subsidising foreign budgets. They show that there are feasible solutions to facilitate tax-advantaged cross-border giving, for instance, based on potentially new double tax treaty provisions (Oberson) or more liberal national policies in this field (Silver).

The fourth major topic of the handbook, “Tax incentives for hybrid entities and social entrepreneurship “, explores the phenomena of corporate philanthropy and social entrepreneurship, inquiring into, among other things, the rationale of the traditional distinction between charity and business, which is now often blurred. The authors inquire into such topics as the distinction between donations and sponsorship (Hemels), the new entrepreneurial models of cultural organisations (Koolen-Maas/ van Teunenbroek/Bekkers) and the possibilities for larger exemptions for social enterprises in the framework of current tax and competition laws (Gani).

Finally, the Handbook also includes the OECD report “Taxation and Philanthropy,” which was published in November 2020 in the context of the research project that led to this book (hereafter the “OECD report”). The OECD Report is the first in-depth comparative analysis of the legal norms and practices in the field, providing precious empirical data in this domain, gathered through country questionnaires from 40 OECD members and participating countries in the framework of collaboration between the OECD and the Geneva Centre for Philanthropy of the University of Geneva.

Due to the vastness of the domain, it would be unwise to say that this book covers all the problems and questions that arise when taxation and philanthropy meet. A number of the issues and problems raise more questions than answers and call for further research. However, this was also the aim of the editors – to encourage further discussions and to open the way to further developments in this new, larger field, which could now truly be called “the science of philanthropy”.

Authors