What if … philanthropy jumpstarts a new digital currency for ecological regeneration? Investing in ecology and longevity by new means

UN Secretary-General António Guterres described the climate emergency as “the defining issue of our time”[1]. Renowned naturalist David Attenborough spoke before the UN Security Council, identifying climate change as “the biggest threat to security that modern humans have ever faced”. He elaborated: “If we continue on our current path, we will face the collapse of everything that gives us our security”[2] – including food production, access to fresh water, and a habitable ambient temperature. That was back in February 2021 …

Yet 2022 is already defined by historic distractions from this overarching problem – this year brings the third year of the Covid-19 pandemic, a war of aggression in Ukraine, rising migration, declining democracies, high inflation, broken supply chains, public distrust, lack of progress. The list of these multiple crises is ongoing. It highlights the path dependencies holding us back from how people really want to live – in peace and with care.

What if a systemic approach to impact investment connects rapid crisis response with transformative change?

The launching of a bold regenerative investment approach is more urgent than ever. Sustainable investment schemes have been discussed for quite some time e.g. Climate Coin, Carbon Currency or KlimaDAO. While these approaches are important steps in the right direction, their mental model is too often based on humanity and nature being separate, rather than interdependent.

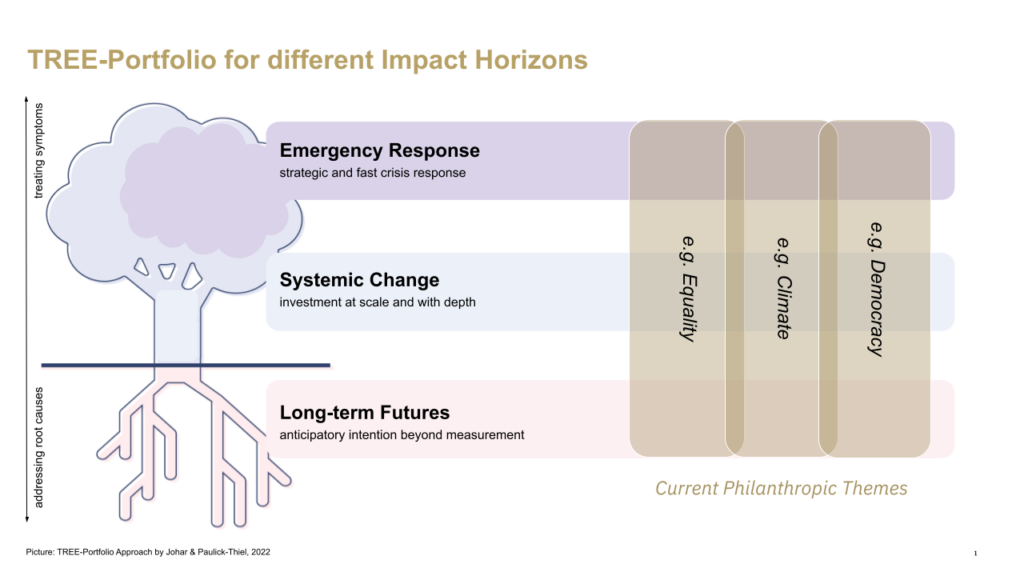

A caring philanthropy has to combine short-term crisis response and long-term systemic transformation. Recognising interdependencies between different impact horizons will be key e.g. relative economic stability (short term), promoting a regenerative economy (mid-term) and providing for future generations (long term). Thinking in long-term futures opens up a circular approach to investing in which capital is able to replicate and start to create life around itself. Systemic change implies a better understanding of volatile dynamics and preferred system states that are co-beneficial to human and planetary health. When these baselines are established e.g. by adopting a TREE portfolio (see image below), rapid crisis responses can contribute strategically to addressing root causes.

What if unprecedented amounts of financial capital are turned into social capability in order to secure humanity’s future?

Achieving the Paris Agreement goals[3] is not possible without massive investments at speed and scale[4]. The OECD estimates that $6.9 trillion a year is required up to 2030 to meet climate and development objectives[5]. Even though our generation hasn’t done this before, there are examples that should be considered: “When the US joined the second world war, it transformed itself from a largely civilian economy to a military economy in a similar period. … The federal government spent more money between 1942 and 1945 than it did between 1789 and 1941. With similar determination and resources, …we could transform ourselves from a high- to a low-carbon economy just as swiftly and decisively.”[6]

Philanthropy could play a major role in this transformation. Imagine for a moment: all Philea member organisations donate a portion of their budget into underpinning a dedicated digital currency for ecological transformation – let’s call it the ECO. ECO’s sole purpose would be to finance transition – divesting from fossil fuels and investing in ecology. As a separate currency, the ECO would only be used for purposes that enable sustainable transition for ecology. From rewilding cities, installing solar panels or researching carbon capture technologies, supporting indigenous agriculture to designing sustainable infrastructures – ECOs would only be spent on projects that are transformative. There would be special rules and guidelines that are monitored and updated by an independent oversight body populated by citizens and members of next generations.

Pioneering philanthropists could pave the way towards democratising transformation, especially by enabling the most oppressed populations to have agency in a positive civilizational change[7]. If they build trust for this major transition, governments and normal citizens will be encouraged to follow and build a transformative financial system.European governments could become early movers when shifting their way of budgeting, funding, procuring and taxing the transition from high to low carbon societies. Providers of local currencies and civic investments, green banks and civil society would be invited from the start. The ECO could be the first currency to be designed with and for a society in order to create a better future for all.

Yes, but … This can’t be done. Why not?

Money is an elaborate product of human imagination. We can redesign it, combining a variety of existing concepts. For example, the initial capital of the ECO could be underpinned by a mechanism similar to war bonds: “Debt securities issued by a government to finance military operations and other expenditures in times of war. They are also a means to control inflation by removing money from circulation in a stimulated wartime economy. … Exhortations to buy war bonds are often accompanied by appeals to patriotism and conscience.”[8] Another source of inspiration could be retirement accounts with tax advantages – but for the future. People would pay into it now and only pay taxes IF they withdraw savings that are otherwise meant for future generations.

Furthermore, inflationary pressures on conventional currencies could potentially be reduced by allocating funds for specific ecological purposes with a long-term outlook, rather than adding to the general money supply. Next to the positive there might be negative consequences – but we will only understand those better through prototyping.

What if emerging knowledge feeds back into creating value along the whole investment cycle?

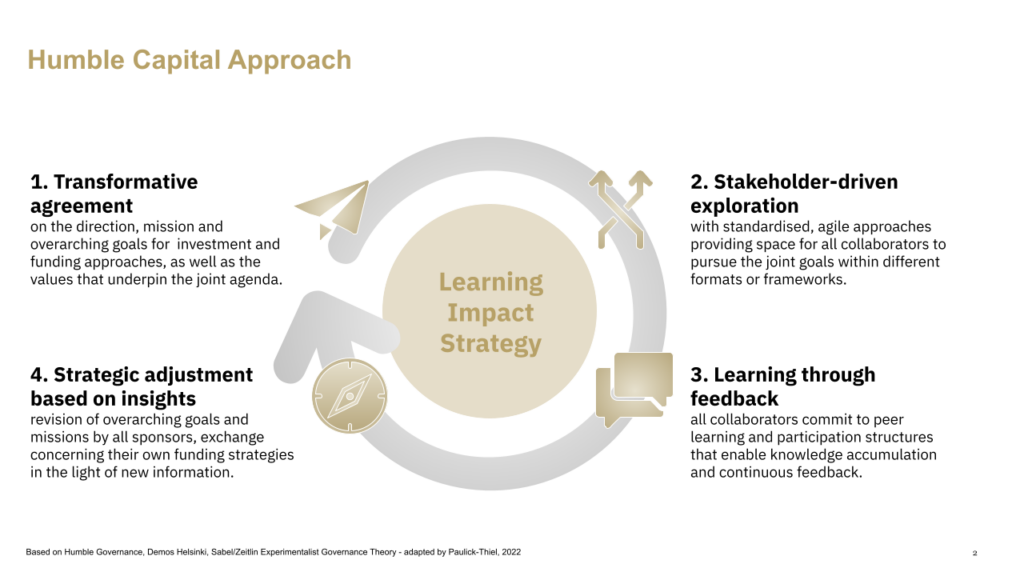

Systemic exploration needs many perspectives and is most effective if combined with a multi-stakeholder learning process. This collaborative knowledge is crucial in order to create value along the whole investment cycle and ensure that investments will create the promised impact. The adaptation of the so-called “Humble Governance”[9] cycle can provide a reliable approach. Translating it to a “Humble Capital” approach would mean agreeing on a transformative framework, rather than a very deep, detailed strategy that defines overarching goals concerning the investment and funding approach, as well as the values that underpin the joint agenda (see image below). This framework leaves space for solving problems in a decentralised manner and in the best possible ways, to be decided by the people who are actually doing the work. They are provided with standardised, agile approaches that offer autonomy for all collaborators to pursue the goals within their frameworks.

At the same time, a new kind of legitimacy mechanism accompanies their activities in order to learn from the different experiences and experiments together. All collaborators commit to peer learning and participation structures that enable knowledge accumulation and continuous feedback – funders included. All participants use a feedback mechanism, supported by an interface or platform that enables frequent collective learning. Based on this emerging real life knowledge, strategic adjustment can be made. Goals and missions can be revised and more effectively adapted in the light of new information. Like this, impact investment is improved and approved through crowd learning.

What if you would be part of this once in a lifetime experiment?

These ideas are simply intended as a basis for further discussion. As governments begin to implement digital currencies[10], and cryptocurrencies[11] are discussed intensely, it is time for economists and experts in finance to contribute their knowledge to creating viable mechanisms for promoting ecological regeneration – with the help of philanthropy. We look forward to your comments, questions and provocations!

[1] UN Security Council. 2021. Climate Change ‘Biggest Threat Modern Humans Have Ever Faced’

[2] UN Security Council. 2021. Climate Change ‘Biggest Threat Modern Humans Have Ever Faced’

[3] IPCC.2022. IPCC Sixth Assessment Report. Climate Change 2022: Impacts, Adaptation and Vulnerability

[4] OECD. 2018. Financing Climate Futures. RETHINKING INFRASTRUCTURE

[5] OECD. 2018. Financing Climate Futures. RETHINKING INFRASTRUCTURE

[6] Monbiot, G. 2022. It’s not too late to free ourselves from this idiotic addiction to Russian gas.

[7] Leyden, P. 2022. The Transformation. A future History of the World from 02020 to 02025, Podcast

[8] https://en.m.wikipedia.org/wiki/War_bond, last visit 20.04.2022

[9] Demos Helsinki. 2021. Humble Governance, based on Sabel/Zeitlin Experimentalist Governance Theory, 1989

[10] IMF. 2022. The Future of Money: Gearing up for Central Bank Digital Currency.

[11] Tooze, A. 2022. The end of crypto’s “Wild West”?

Authors