Equalising capital: Using philanthropic assets to address systemic inequalities

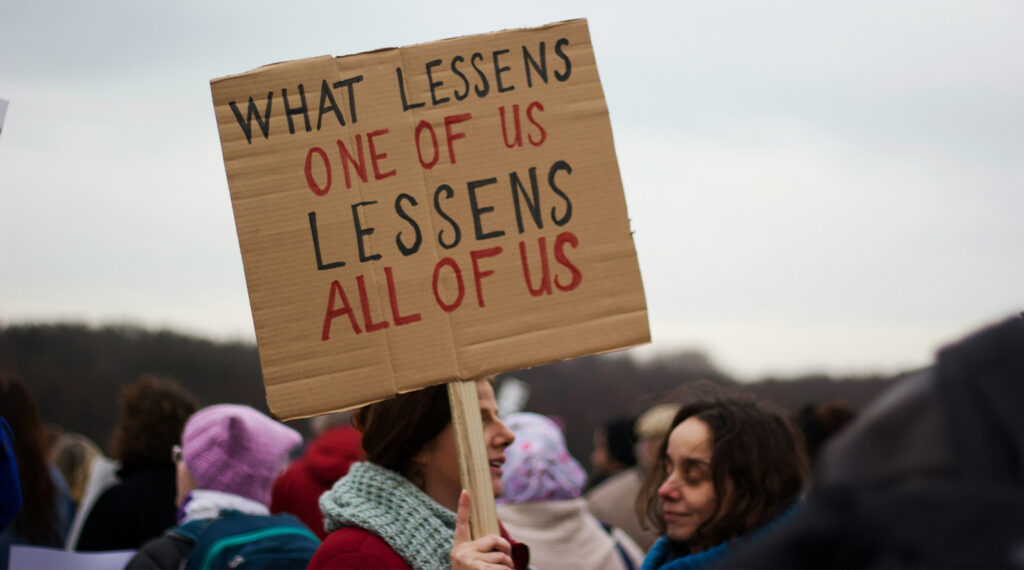

This year started with another devastating reminder of the alarming consequences of unchecked inequalities. In January Oxfam published its most recent research, which found that billionaire wealth surged by a staggering $2 trillion in 2024, a year which also produced an additional 204 new billionaires. Then, as if right on cue, the new US administration offered an illustrative case study of the interwoven nature of wealth, policymaking and power.

For foundation executives observing these and other trends, this is a moment to ask what can be done to confront the challenges of inequalities. Whether the mission is to improve health outcomes, advance education or combat climate change, persistent inequalities make all these that much harder to solve. A further concern is that actions taken in good faith may, inadvertently, reproduce or create new forms of inequalities.

Ultimately, the entrenched and interconnected nature of inequalities can only be addressed by disrupting the structures and systems that lie at their root. This also means recognising that social and economic inequalities cannot be isolated from each other; they are mutually reinforcing. They stem from and result in gross imbalances of power – whether at the level of societal institutions and processes or of groups and individuals.

How do these realities factor into a “theory of change” for the philanthropic sector, no less for an individual foundation? Given that inequalities act as fundamental barrier to the goals foundations seek to achieve, this raises the question of what constitutes an effective – and principled – approach to acting on them.

The following are key insights I’ve gleaned as a long-time observer, participant and avid actor in this field, particularly at the LSE’s International Inequalities Institute, Robert Bosch Stiftung’s Inequality program, the Lankelly Chase Foundation and the Equality Impact Investing Project among others.

1. Start by assessing the ways in which inequalities are relevant by adopting a cross-cutting equity lens. Whether the foundation focuses on democracy, culture, or climate change, a clear entry point is through using an equity lens to uncover the range and nature of the unequal outcomes that effect the communities and/or issue areas and then identify the root causes and structural barriers behind those unequal outcomes. Otherwise, philanthropic efforts risk merely alleviating symptoms rather than driving systemic change. A useful introduction can be found in The Transformative Power of Intersectionality as well as this piece written for Philea by Atje Drexler, Senior Vice-President, Global Issues, Robert Bosch Stiftung. These resources shed light on why using an intersectional approach is essential – to uncover how different forms of inequality overlap and combine with each other to create particular experiences of marginalisation.

2. Combined with this, carry out a power analysis of processes and other aspects of the organisation – from grant sourcing to reporting requirements, to setting strategy and decision-making – to uncover where power imbalances are appearing.

To foster fairer practices, start by looking at the following areas:

- How is the foundation centring the voices and leadership of people with lived experience of inequalities? This applies both to the partner organisations that receive funding and to the foundation itself, since doing one without the other would be paradoxical.

- How are key decisions made and by whom? What are the norms and criteria underpinning decision-making which may need to be re-examined (e.g. those related to risk, impact, scale)?

- How is the foundation working towards greater transparency and accountability?

- Initial resources to help in assessing practices include this guide on Funding Practices from the Association for Charitable Foundations, Trust-based Philanthropy and IVAR’s Open and Trusting Grantmaking Commitments co-created with a community of +100 founders.

3. Ensure that the type of capital offered to partners truly supports their organisational resilience, sustainability and long-term impact. The uncomfortable reality is that a great deal of grantmaking often perpetuates a form of dependency that not only locks recipients into a subservient relationship to their funders but also hampers their ability to make change. While the need to strategise around alternative resourcing approaches has gained sudden visibility following the US government’s decisions around development aid, there is an existing body of work and associated efforts to draw on.

- Are there options to offer differentiated forms of support – and as part of this, multi-year, unrestricted support – tailored to the needs and ambitions of existing partners?

- Going further, are there untapped opportunities to build the economic power of partners and communities?

- For example, the asset base of your key partners can be enhanced which would enable them to achieve greater autonomy. Within this strategy, property is one of several options that could be examined. An evaluation of support provided by the Dreilinden Foundation and Wellspring for property purchases found evidence of multiple, sustained benefits. Building on this work, Dreilinden recently announced a €10m fund for property purchases which will offer both grants and collateral. Another option is to support partners with building their own endowments. The Baobab Foundation is a member-led racial justice fund that has made significant inroads with building its endowment. Partners that may face pressure from their governments for receiving foreign funding (or “woke” funding as may be the case) would certainly benefit from the independence that an endowment allows, and there seem to be more examples of funders considering this.

- Another promising and emerging approach is community wealth building, which enables communities to lead and control their own investment funds, with a view to democratising local economies. In a similar vein, the West African Civil Society Institute has called for greater emphasis on wealth creation as a central pillar for civil society sustainability strategies. I will be publishing research on this area in the coming months – please get in touch if you’d like to receive it.

4. Reimagine the “wealth-holder” role: allocate all capital as a lever of change.

- The vast majority of foundation wealth is held in endowments, often invested in ways that, at worst, contradict their stated missions, or at best, align with ESG criteria, which may assist in managing risk (not to be confused with contributing to positive impact). Foundations with a stated commitment to reducing inequalities should not be investing in companies or financial products that, for example, exploit workers, harm the environment, damage communities, undermine democratic processes or benefit from armed conflict.

- Mission-aligned investing ensures that the entire financial portfolio – not just grants – works towards supporting core objectives. It is promising to see that more foundations are taking this “total asset” approach, using the full range of their assets (financial, human resources, expertise, networks, etc.) to drive impact. The Heron Foundation has shifted nearly all of its assets to mission-aligned investments, ensuring that its wealth is actively working towards economic justice. The Kataly Foundation and the Tudor Trust are two further examples, among several others.

- As asset owners, foundations can be more proactive in shareholder engagement efforts. The Nathan Cummings Foundation is a leading example in this space. Also crucial is for foundations to become vocal constituents in the movement to generate alternatives to and within the current system of finance, which functions as a major impediment to efforts to reduce inequalities.

- Ultimately, foundation executives, board members and programme teams should build their own knowledge base on these topics, so that approaches to capital stewardship are developed with broader input. Too often, this domain within foundations is primarily left to those with traditional finance expertise, either outsourced to external financial advisors, internal teams and/or Board members. As a result, novel approaches to utilising capital may be overlooked or dismissed, either due to limited awareness or even a biased towards this approach. This is why it is essential to engage more perspectives in discussions around foundation finances, and one that requires careful preparation and planning.

Current trends seem to be pushing the foundation sector towards a period of transformation. While the medium or long-term outlook of recent policy decisions remains to be seen, this clearly is a moment to reflect critically on how financial and other resources are amassed, controlled and used. Along with more frank conversations about philanthropy’s contradictory relationship to extractivist social and economic systems rooted in inequalities, there is an opportunity to join a growing community within philanthropy that is offering alternative visions and solutions at the nexus of wealth, power and equality.

Authors