Betwixt and between: Banking foundations bridging legacy and better futures, societal and market forces

Section

In 2021 the EFC (now Philea) co-organised a couple of peer exchanges together with Nordea-Fonden to create a space for foundations of banking origin to share experiences, challenges, and ideas. The discussions took stock of the most critical issues these foundations currently deal with, including strategic directions, external communications, investments, and stakeholder relationships. What became clear in these gatherings is that although each foundation has a different organisational structure and relationship with its parent bank and reflects the unique features of social and historical context where it is embedded; the banking legacy presents a common, set of opportunities and challenges across foundations of banking origin in various countries.

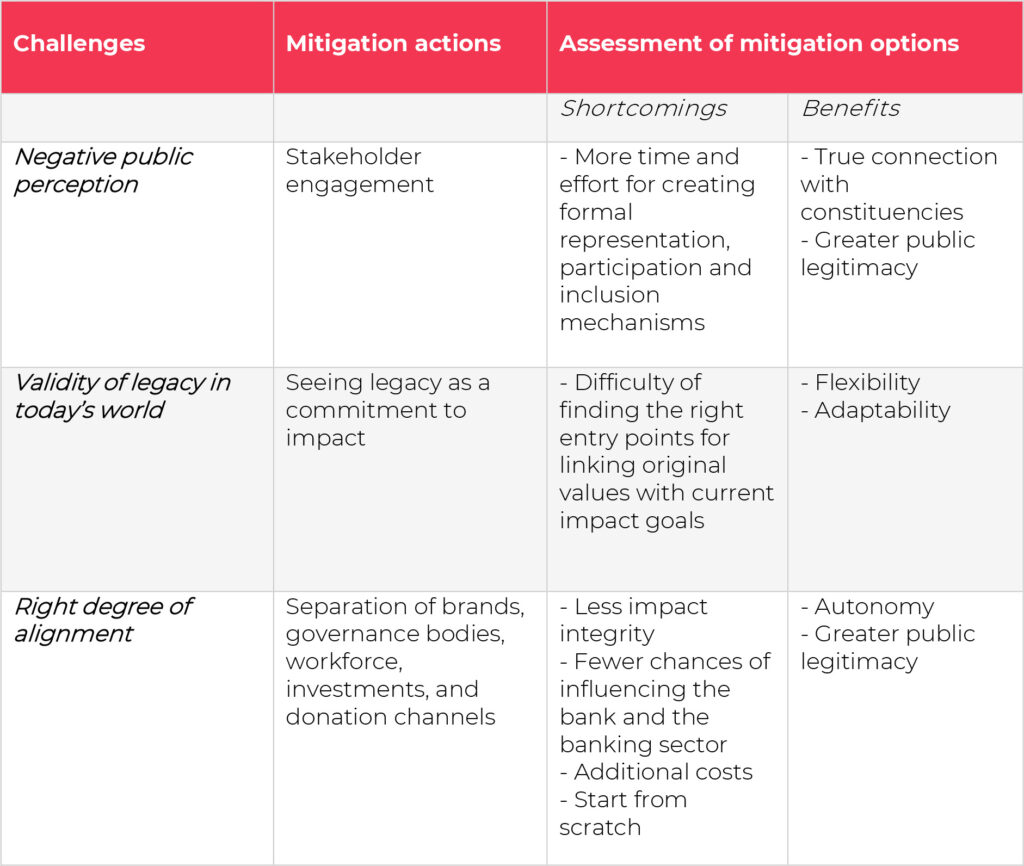

While addressing those opportunities and challenges, foundation leaders continuously have to decide between many sound options. These are more than just simple choices, as they may conflict with the multiple and competing demands of diverse stakeholders, and usually require executives to think long and hard about the outcomes of the choices. This report lays out some of the challenges facing banking foundations, actions to mitigate them, and potential shortcomings and benefits of those actions in order to both shed light on the tensions inherent in their identity and to highlight the special, positive characteristics of this type of foundation.

Public confusion on brand identity and the legitimacy question

The main challenge affecting banking foundations is related to their public image. Banking foundations, even those that have autonomous governance bodies and separate investment strategies, share a common history with their parent bank which has important implications for their legitimacy and how stakeholders perceive them. Legitimacy issues come to the fore especially at delicate moments and times of crisis, such as the 2008 global financial crash, which put a real strain on banks’ legitimacy. Activities and investments of the bank that are not in line with the philanthropic purpose of the foundation have the ability to hijack the image of the foundation.

As a mitigation action, some foundations split from the bank while remaining the main shareholder of the commercial arm. Despite the legal and structural separation, the public continues to see them as parts of the same entity and take for granted that the foundation will work towards contributing to the business objectives of the bank rather than prioritising the needs of the community. As a result, foundations feel a burden relating to their external communication and branding.

Stakeholder approach to branding

Should banking foundations keep their branding similar to that of their bank or should they create an entirely new brand? Having a similar (or same) brand as the bank can create the advantage of being easily recognised as a well-established institution: However, it can also transfer both the positive and negative aspects of the bank’s reputation to the foundation and foster confusion between the two entities. On the other hand, creating a new brand comes with the advantage of a clearer separation between the entity of the foundation and that of the bank: However, this approach also involves the disadvantage of incurring extra costs to build the new brand and being less easily recognisable at the beginning. Consequently, foundations are assessing these trade-offs and exploring how they can build a stronger communications strategy, not only to avoid confusion between the entities but also to promote their identity, mission and work. Clearly communicating their purpose, achievements, failures, and new initiatives or adaptations undertaken in response to constituent feedback helps foundations manage the external perceptions to some extent.

Genuine engagement rather than tokenism

It is becoming more and more evident that managing stakeholder perceptions and building legitimacy is not only a matter of brand strategy. Banking foundations need to set themselves up as informed and responsive partners to their communities, rather than as elitist institutions, interacting openly with their key stakeholders to understand challenges facing communities and to shape the most effective strategies for addressing those issues. To demonstrate that they are centring the most impacted individuals and communities, the foundations should go beyond token focus groups and listen to, engage with, and co-create tailored solutions together with these groups. It is equally important to have a workforce that is meaningfully diverse across all levels and reflects the communities they serve. For this, foundations have started to place a more deliberate and intentional emphasis on inclusive hiring and finding candidates from a broader range of backgrounds.

Legacy as a commitment to change vs a limiting force

Despite its challenges, banking legacy is not something foundations want to totally distance from. In some cases, the parent banks started out as saving banks, then made part of the cooperative movement in their respective countries, and later were merged into limited companies. Foundations of savings banking origin are proud of these noble beginnings. Nevertheless, they are struggling to find a way to get that legacy to work in modern society as the public either no longer remembers the cooperative movement or finds it irrelevant to the current needs. Legacy isn’t just about honouring the past. Taking it as a commitment to be impactful in the present and creating a better future, rather than a prescribed mandate, provides foundations with more flexibility in responding to the challenges and opportunities never imagined by the initial donors.

To align or not to align?

Beyond the challenges related to public perceptions, foundations are questioning the benefits and drawbacks of alignment with their parent bank, especially when it comes to their financial engagements. In some cases, an important share of the foundation’s capital is invested in the shares of the parent bank. Do these financial ties hinder yield opportunities or are they good for foundations’ yield and thereby support grantmaking?

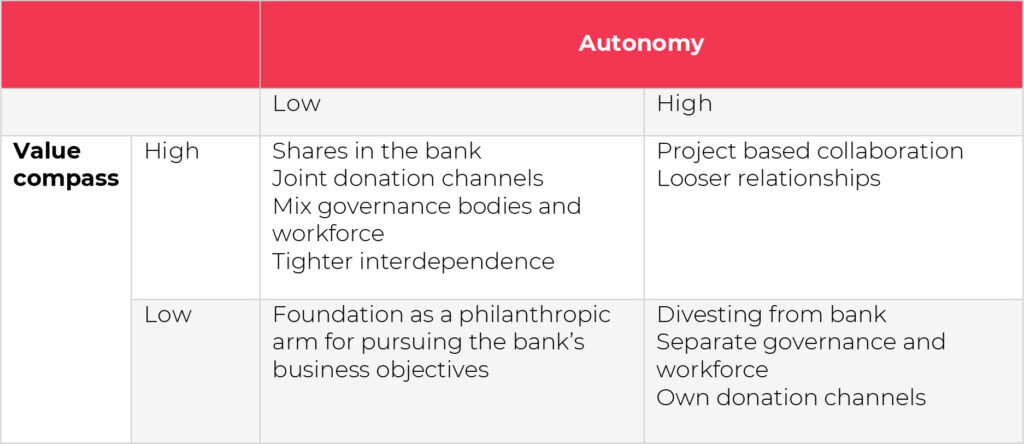

Alignment between the foundation and its parent bank can occur at various levels, from strategic to operational. As the most common form of alignment, making best use of the banks’ branch network helps foundations to expand their outreach. Nevertheless, banking foundations need to decide which donation collection strategy works best for them, considering advantages and disadvantages of each approach. Using the branches of their bank as a distribution network has the advantage of having an already well-established financial system. As a shortcoming of this approach, the bank may impose requirements that benefit itself, but not the foundation. For instance, the bank may require the donor to open a bank account within the bank to complete a donation, which further contributes to brand confusion and questions about the foundation’s ability to pursue public interests. On the other hand, centralising donations at the foundation comes with the advantage of having autonomy over the process. Nonetheless, it has the disadvantage of having to create a new system from scratch.

Transforming the banking sector

Some foundations see their access to the bank as a unique opportunity for guiding the bank in its practice, functioning, and dealing with the donor stocks. Foundations indeed can and do use their link to their parent bank to improve the banking sector’s engagement in the social domain. Since banks are quite rigid and set in their ways, foundations can help the bank become more flexible and ready to innovate in order to meet current challenges and adapt to changing circumstances. Foundations that have a degree of influence over the activities of the bank can ensure that the bank has a long-term vision and mission, as it is difficult for foundations to act in any other way than to aim for long-term goals and change. Nevertheless, ensuring innovation and preparedness to meet the current challenges of the world can be challenging where the boards of the foundations are in part populated by officers of the bank who may understand matters related to finance but may not be as open to innovation as desired. Moreover, although differences in the approaches, competencies, and working styles of the foundation and the bank provide an opportunity for complementing one another, when not managed well, they may cause tensions between the two entities.

Acting as a moral compass

It is not only the knowledge, the networks, and the innovation power of foundations that have value in making the bank a better commercial institution. Foundations keep the bank “on track” and in line with the original values of the founders, and they make sure constituents’ voices are heard by serving as intermediaries between banks and society. In other words, the foundation acts as a moral compass, which incentivises the bank to get involved in social causes while also influencing it to not take actions that would harm the social agenda, all the while emphasising the positive implications for the bank in doing so, such as an enhancement of the legitimacy of the bank. Influencing the commercial bank can, however, become more difficult when the foundation reduces its shareholding. The question of how it is possible to influence decisions in the bank when the shareholding is small keeps the banking foundations’ minds busy.

Mutually reinforcing benefits of collaboration

Collaboration can take many different forms. While some banks develop their own social programmes, in other cases they outsource this to foundations, as the armour of their social and philanthropic activity. Foundations of banking origin have the opportunity to involve the bank in social and philanthropic projects that it would normally not support. Collaboration between the foundation and the bank has other benefits too. Combining commercial knowledge with that from civil society can lead to new initiatives that are beneficial for society as a whole. For instance, as a result of a dialogue between Erste Bank and ERSTE Foundation, the Zweite Bank was launched as a socially oriented bank run exclusively by volunteers from Erste Bank and the Sparkassen group and does not aim for any profits.

Foundations have a wealth of options for configuring their alignment with their parent banks. It is common to consider that where alignment becomes loose, the foundation is more likely to retain autonomy but less likely to have the ability to positively influence the bank’s social and environmental business practices. On the other hand, it is believed that tighter alignment increases a foundation’s ability to influence the bank toward more sustainable and inclusive practices while decreasing the degree of autonomy, which then causes the foundation to risk losing its social license to operate. Questions about banking foundations’ legitimacy have revolved around the risks connected with creating business benefits at the expense of social impact and being an instrument for the bank in influencing public policies. In this context, it is important to remember the opportunities provided by hybridity of this organisational type relating to giving the foundation and the citizens the possibility to influence private undertakings’ initiatives. That’s why we should seek out and prize reciprocal relationships in alignment discussions. This requires that we describe and quantify how the two entities are interacting, not only what they are doing together.